26 CFR 1.871-1(a) (a) Classes of aliens. For purposes of the income tax

26 CFR 1.871-1(a)

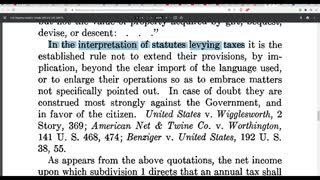

(a) Classes of aliens. For purposes of the income tax, alien individuals are divided generally into two classes, namely, resident aliens and nonresident aliens. Resident alien individuals are, in general, taxable the same as citizens of the United States; that is, a resident alien is taxable on income derived from all sources, including sources without the United States. See § 1.1-1(b). Nonresident alien individuals are taxable only on certain income from sources within the United States and on the income described in section 864(c)(4) from sources without the United States which is effectively connected for the taxable year with the conduct of a trade or business in the United States. However, nonresident alien individuals may elect, under section 6013 (g) or (h), to be treated as U.S. residents for purposes of determining their income tax liability under Chapters 1 and 24 of the code. Accordingly, any reference in §§ 1.1-1 through 1.1388-1 to non-resident alien individuals does not include those with respect to whom an election under section 6013 (g) or (h) is in effect, unless otherwise specifically provided. Similarly, any reference to resident aliens or U.S. residents includes those with respect to whom an election is in effect, unless otherwise specifically provided.

-

6:54

6:54

FreedomLawSchool

1 year ago(FAQ) Non-US Citizens pay income taxes

15.1K -

5:01

5:01

lilanikesa

1 year agoIRS Workers & Researchers on the Legality of Income Tax

5 -

29:06

29:06

FreedomLawSchool

1 year agoDoes the “Includes and Including” clause in IRC 7701(c) mean you are INCLUDED as a taxpayer?

110 -

1:53:36

1:53:36

FreedomLawSchool

7 months agoDoes the “Includes and Including” clause in IRC 7701(c) mean you are INCLUDED as a taxpayer?

1.49K12 -

0:44

0:44

Ron DeSantis

2 years agoTax Dollars Will NOT Fund CRT

91228 -

42:23

42:23

FreedomLawSchool

1 year agoThe IRS is mostly bluff! Call their Bluff and be free of Income Taxes!

36 -

42:33

42:33

Kat Espinda

1 year agoEP. 29 - Are EWE Still Paying Income Taxes? GET OUT OF THE TAX CLUB NOW!

1.34K21 -

8:11

8:11

Bequest

1 year agoAlternative Asset Classes, Cash Flow, and Taxes

13 -

0:13

0:13

Ron DeSantis

2 years agoNo Tax Dollars for CRT

4.93K84 -

1:31

1:31

Imagine

1 year agoIncome Taxes?

115