Premium Only Content

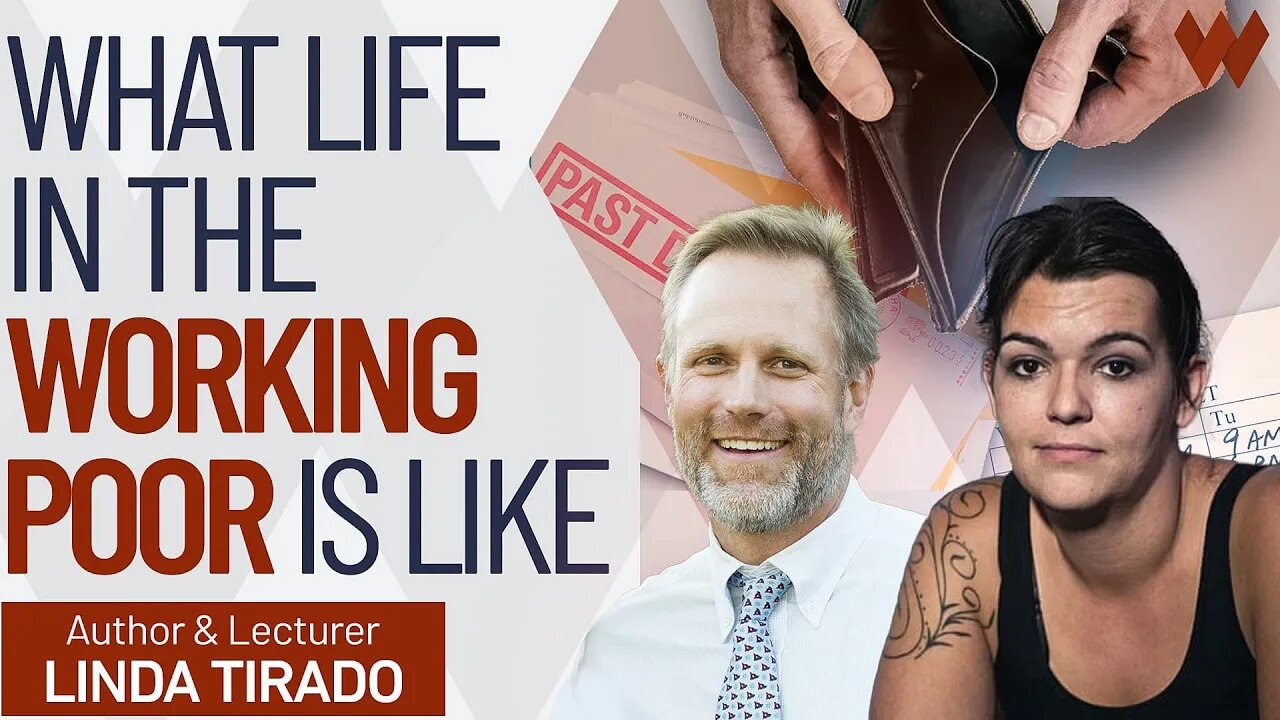

Life For The Working Poor: A Painfully Honest Look At Living Hand To Mouth | Linda Tirado

GET THE FREE ARTICLE of Linda's original online post that catapulted her into spokesperson for America's working poor. Simply go to https://wealthion.com/poor

It’s true that money does not equal happiness.

But the lack of money too often traps people in what’s called the “working poor”, an unhappy state of paycheck-to-paycheck living defined by stress, exhaustion, overwork and a chronic inability to get ahead of one’s monthly bills.

Nearly 1 in 3 people in America live in financial insecurity.

In this video with Linda Tirado, author of 'Hand To Mouth: Living in Bootstrap America", we take an honest direct look at the challenges facing so many of those living in a perpetual struggle of survival. And why it's so difficult to escape the gravity well of financial need once you're stuck within it.

This is a very important and timely topic for our society that is not receiving enough frank discussion today.

Join us for one now, and then download (for free) Linda's original online post that catapulted her into spokesperson for America's working poor at https://wealthion.com/poor

And follow Linda on Twitter @KillerMartinis

At Wealthion, we show you how to protect and build your wealth by learning from the world’s top experts on finance and money. Each week we add new videos that provide you with access to the foremost specialists in investing, economics, the stock market, real estate and personal finance.

We offer exceptional interviews and explainer videos that dive deep into the trends driving today's markets, the economy, and your own net worth. We give you strategies for financial security, practical answers to questions like “how to grow my investments?”, and effective solutions for wealth building tailored to 'regular' investors just like you.

There’s no doubt that it's a very challenging time right now for the average investor. Above and beyond the recent economic impacts of COVID, the new era of record low interest rates, runaway US debt and US deficits, and trillions of dollars in monetary and fiscal stimulus stimulus has changed the rules of investing by dangerously distorting the Dow index, the S&P 500, and nearly all other asset prices. Can prices keep rising, or is there a painful reckoning ahead?

Let us help you prepare your portfolio just in case the future brings one or more of the following: inflation, deflation, a bull market, a bear market, a market correction, a stock market crash, a real estate bubble, a real estate crash, an economic boom, a recession, a depression, or another global financial crisis.

Put the wisdom from the money & markets experts we feature on Wealthion into action by scheduling a free consultation with Wealthion’s endorsed financial advisors, who will work with you to determine the right next steps for you to take in building your wealth.

SCHEDULE YOUR FREE WEALTH CONSULTATION with Wealthion's endorsed financial advisors here: https://www.wealthion.com/

Subscribe to our YouTube channel https://www.youtube.com/channel/UCKMeK-HGHfUFFArZ91rzv5A?sub_confirmation=1

Follow Adam on Twitter @menlobear

Follow us on Facebook https://www.facebook.com/Wealthion-109680281218040

#inequality #poverty #money

____________________________________

IMPORTANT NOTE: The information and opinions offered in this video by Wealthion or its interview guests are for educational purposes ONLY and should NOT be construed as personal financial advice. We strongly recommend that any potential decisions and actions you may take in your investment portfolio be conducted under the guidance and supervision of a quality professional financial advisor in good standing with the securities industry. When it comes to investing, past performance is no guarantee of future results. Any historical returns, expected returns, or probability projections may not reflect actual future performance. All investments involve risk and may result in partial or total loss.

-

10:46:42

10:46:42

Rallied

11 hours ago $12.73 earnedWarzone Challenges w/ Doc & Bob

177K3 -

3:26:25

3:26:25

Joe Donuts Live

4 hours ago🟢 Lost in Space with My Clones: The Alters Adventure Begins

21.6K -

7:20:22

7:20:22

Dr Disrespect

13 hours ago🔴LIVE - DR DISRESPECT - TRIPLE THREAT CHALLENGE - WINNING AT EVERYTHING

203K12 -

2:35:33

2:35:33

Chrono

6 hours agoBirthday-eve Stream | Helldivers II

18.4K1 -

54:40

54:40

BonginoReport

1 day agoLABOR DAY SPECIAL! The Best of Nightly Scroll - Nightly Scroll w/ Hayley Caronia (Ep.124)

119K14 -

2:39:21

2:39:21

Joker Effect

4 hours agoReviewing the downfall of Kick Streaming. Kick streamers welcome to Rumble! Stake bombshell found!

27.9K1 -

1:06:10

1:06:10

Russell Brand

13 hours agoThe Greatest Lie Ever Told? - SF625

92K111 -

3:25:13

3:25:13

elwolfpr

5 hours agoBlack Ops 6: Rise of the Relentless

10.5K1 -

LIVE

LIVE

Phyxicx

4 hours agoChillin - For The King - 9/1/2025

11 watching -

LIVE

LIVE

Spartan

9 hours agoNew Game+ on E33, then back to Halo Grind

60 watching