Premium Only Content

Is The U.S. Top Bank About To Start A Recession

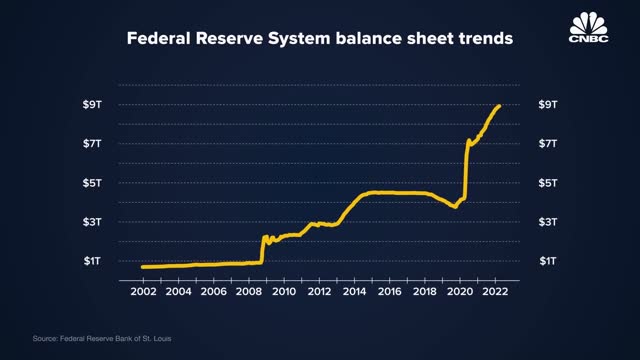

America's central bank, the Federal Reserve, can inject cash into the financial sector to prevent breakdowns during emergencies. One way it does so is through the large-scale purchase of bonds. The central bank has racked up nearly $9 trillion in bonds to calm investors during past crises. The Fed is saying it will soon dial back this program. The pace at which the Fed tightens monetary policy may create substantial market headwinds.

Members of the Federal Reserve are debating how quickly to reduce the central bank’s portfolio of bonds, without starting a recession.

Heading into the second quarter of 2022, the balance of Federal Reserve’s assets is almost $9 trillion. The majority of these assets are securitized holdings of government debt and mortgages. Most were purchased to calm investors during the subprime mortgage crisis in 2008 and 2020′s pandemic.

“What’s happened is the balance sheet has become more of a tool of policy.” Roger Ferguson, former vice chairman of the Federal Reserve Board of Governors, told CNBC. “The Federal Reserve is using its balance sheet to drive better outcomes in history.”

The U.S. central bank has long used its power as a lender of last resort to add liquidity to markets during times of distress. When the central bank buys bonds, it can push investors toward riskier assets. The Fed’s policies have boosted U.S. equities despite tough economic conditions for small businesses and ordinary workers.

Kathryn Judge, a professor at Columbia Law, says the Fed’s stimulus is like grease for the gears of the financial system. “If they apply too much grease too frequently, there are concerns that the overall machinery becomes risk-seeking and fragile in alternative ways,” she said to CNBC in an interview.

Analysts believe that the Fed’s choice to raise interest rates in 2022 then quickly reduce the balance sheet could set off a recession as riskier assets are repriced.

Watch the video above to learn more about the recession risks of the Fed’s monetary policies.

-

4:10

4:10

Blackstone Griddles

12 hours agoCajun Dogs with Bruce Mitchell

3921 -

29:38

29:38

Uncommon Sense In Current Times

13 hours agoIs Doubt a Sin? Wrestling with Faith & Belief (Part 1) | Dr. Randal Rauser

5.97K3 -

8:29

8:29

The Art of Improvement

19 hours ago4 Strategies To Accelerate Your Personal Growth By 200%

631 -

LIVE

LIVE

The Bubba Army

21 hours agoTrump Pardoning Diddy? - Bubba the Love Sponge® Show | 7/30/25

3,225 watching -

10:53

10:53

Nikko Ortiz

1 day agoWORST Clips On The Internet

58.1K21 -

27:44

27:44

DeVory Darkins

16 hours ago $4.62 earnedCHILLING update regarding NYC shooter Lefties LOSING IT over Sydney Sweeney

11.1K83 -

10:05

10:05

MattMorseTV

15 hours ago $10.65 earnedHe actually did it...

76.5K36 -

LIVE

LIVE

Midnight In The Mountains

1 hour agoMorning Coffee w/ Midnight & The Early Birds of Rumble | Tsunami's Railing Cali ...

81 watching -

2:20:02

2:20:02

Side Scrollers Podcast

20 hours agoSYDNEY SWEENEY JEANS CONTROVERSY BREAKS THE INTERNET + TWITCH APOCALYPSE + MORE | SIDE SCROLLERS

77.6K15 -

3:10:02

3:10:02

Price of Reason

14 hours agoTrump Tariffs Are GOOD? Syndey Sweeney Faces WOKE Backlash! Fantastic Four FLOPS! Mouthwashing BAN!

5.83K6