Premium Only Content

Is The U.S. Top Bank About To Start A Recession

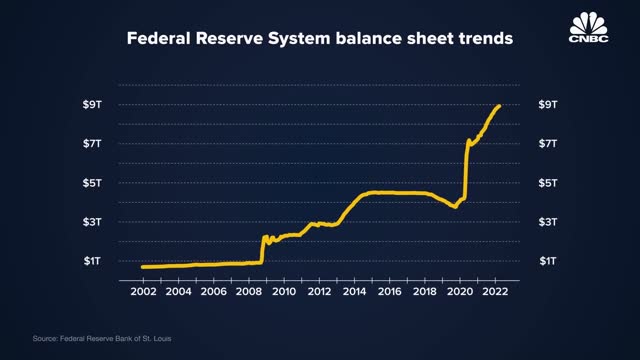

America's central bank, the Federal Reserve, can inject cash into the financial sector to prevent breakdowns during emergencies. One way it does so is through the large-scale purchase of bonds. The central bank has racked up nearly $9 trillion in bonds to calm investors during past crises. The Fed is saying it will soon dial back this program. The pace at which the Fed tightens monetary policy may create substantial market headwinds.

Members of the Federal Reserve are debating how quickly to reduce the central bank’s portfolio of bonds, without starting a recession.

Heading into the second quarter of 2022, the balance of Federal Reserve’s assets is almost $9 trillion. The majority of these assets are securitized holdings of government debt and mortgages. Most were purchased to calm investors during the subprime mortgage crisis in 2008 and 2020′s pandemic.

“What’s happened is the balance sheet has become more of a tool of policy.” Roger Ferguson, former vice chairman of the Federal Reserve Board of Governors, told CNBC. “The Federal Reserve is using its balance sheet to drive better outcomes in history.”

The U.S. central bank has long used its power as a lender of last resort to add liquidity to markets during times of distress. When the central bank buys bonds, it can push investors toward riskier assets. The Fed’s policies have boosted U.S. equities despite tough economic conditions for small businesses and ordinary workers.

Kathryn Judge, a professor at Columbia Law, says the Fed’s stimulus is like grease for the gears of the financial system. “If they apply too much grease too frequently, there are concerns that the overall machinery becomes risk-seeking and fragile in alternative ways,” she said to CNBC in an interview.

Analysts believe that the Fed’s choice to raise interest rates in 2022 then quickly reduce the balance sheet could set off a recession as riskier assets are repriced.

Watch the video above to learn more about the recession risks of the Fed’s monetary policies.

-

3:17:28

3:17:28

TimcastIRL

6 hours agoTrans Shooter Targets Catholic Kids In Mass Shooting, Leftists Reject Prayers | Timcast IRL

220K61 -

1:31:29

1:31:29

Brandon Gentile

1 day ago25 Year Wall Street INSIDER: $1M Bitcoin Soon Is Just The START

18.2K -

SpartakusLIVE

8 hours ago#1 Birthday Boy Celebrates with MASSIVE and HUGE 4.8-Hour Stream

50.9K -

55:54

55:54

Man in America

9 hours agoFrom Oil Barons to Pill Pushers: The Rockefeller War on Health w/ Jeff Adam

47K6 -

3:02:18

3:02:18

Barry Cunningham

6 hours agoBREAKING NEWS: PRESIDENT TRUMP THIS INSANITY MUST END NOW!

92.8K181 -

3:58:27

3:58:27

StevieTLIVE

5 hours agoWednesday Warzone Solo HYPE #1 Mullet on Rumble

37.8K -

5:58

5:58

Mrgunsngear

7 hours ago $3.67 earnedBreaking: The New Republican Party Chairman Is Anti 2nd Amendment

29.3K11 -

2:28:35

2:28:35

Geeks + Gamers

6 hours agoGeeks+Gamers Play- MARIO KART WORLD

28.7K -

![(8/27/2025) | SG Sits Down Again w/ Sam Anthony of [Your]News: Progress Reports on Securing "We The People" Citizen Journalism](https://1a-1791.com/video/fww1/d1/s8/6/G/L/3/c/GL3cz.0kob.1.jpg) 29:34

29:34

QNewsPatriot

7 hours ago(8/27/2025) | SG Sits Down Again w/ Sam Anthony of [Your]News: Progress Reports on Securing "We The People" Citizen Journalism

21.8K6 -

25:12

25:12

Jasmin Laine

11 hours agoDanielle Smith’s EPIC Mic Drop Fact Check Leaves Crowd FROZEN—Poilievre FINISHES the Job

24.5K25