Premium Only Content

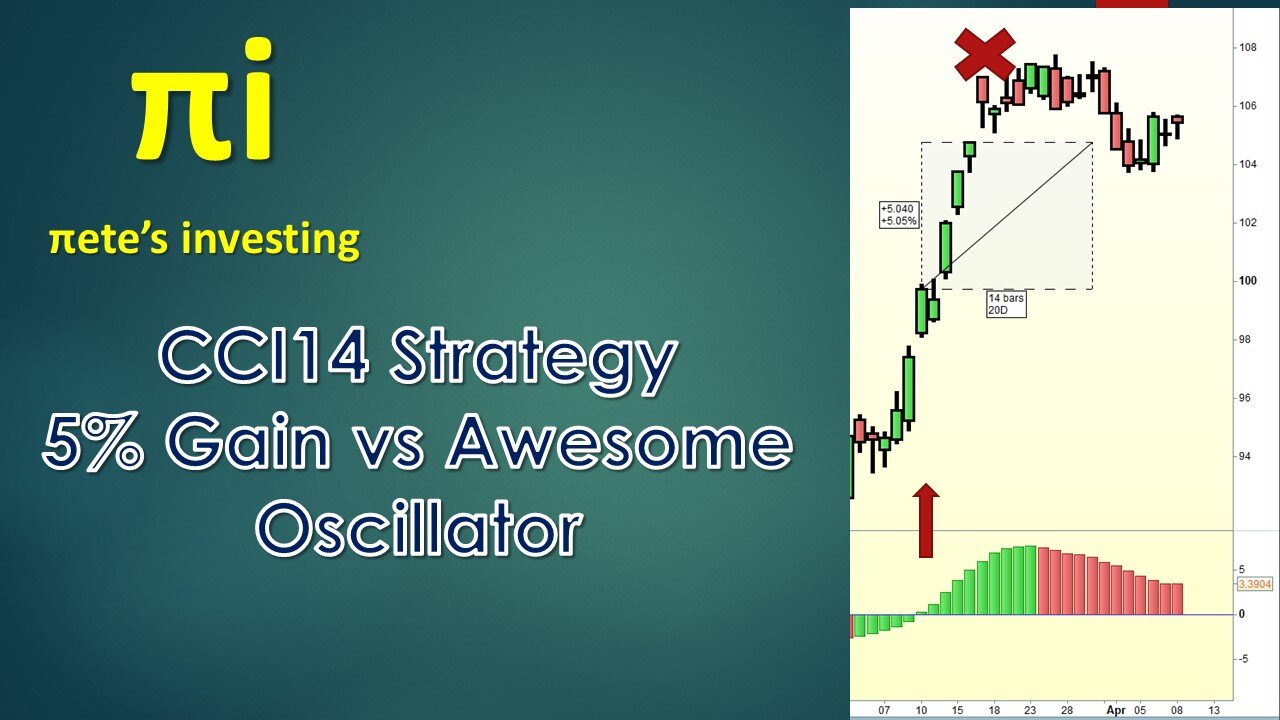

Trading the CCI14 strategy with Average Down vs Awesome Oscillator crossing over zero.

Trading the CCI14 strategy with Average Down vs Awesome Oscillator crossing over zero.

Welcome to Pete’s investing updates

in this strategy edition we will be talking about .... ( Simple Trading with the Commodity Channel Index strategy and applying a % Gain and Average Down approach)

Don't forget...

First always remember to review petesinvesting channel playlists

Updated every weekend I look at the charts of some select blue chip shares as well as some key world sharemarket indices.

As always click on the SUBSCRIBE button as well as the NOTIFICATION bell and LIKE this video to support this channel.

If you want me to review an Index a share, a commodity or a FOREX pair, put it in the comments and I'll cover it in a future video

Things

to consider:

•We track and trade on a Daily chart since we want to back test and see results of trades back during the GFC as well as Covid effects.

•We track and back test Revenue over Drawdown requirements

(as a %) to optimize our returns with less exposure.

•Brokerage is included in our back testing. I use $8 per transaction each time we buy or sell. Revenue shown may change slightly depending on your brokerage costs.

•Our Back testing transacts with $2,000 per trade. ie everytime you purchase $2k worth of shares in the instrument you want to invest.

To increase Revenue (ie returns) simply increase this. But beware this will also increase your Drawdown, so ensure you factor in this with your money management strategy.

Lets get started

Remember...

Don't forget to subscribe / LIKE and hit the notification bell and review the PETESINVESTING channel playlists for further reference.

Using a Daily price chart, we review the weekly progress of a sample of Bluechip stocks from Australia, the US and Europe - Telefonica (TEF.BME), Commonwealth Bank Of Australia (CBA.AX), BHP Group Ltd Australia (BHP.AX), JPMorgan and Chase (JPM.NYSE), Volkswagen AG (VOW.XETRA), Johnson & Johnson (JNJ.NYSE), Caterpillar Inc (CAT.NYSE).

Showing any new open and closed positions, profitability and draw down requirements dependent on the trend of the respective price charts.

Supporting videos:

Alligator strategy explained:

https://youtu.be/1SMSRQV7GZE

Rumble updates

https://rumble.com/register/peteeight/

Bitchute updates:

https://www.bitchute.com/channel/pTjWs2A7K9Br/

Become a PetesInvesting Patreon member with same day updates on

https://www.patreon.com/petesinvesting

Money Management:

https://youtu.be/nvvcldeeZS4

Average Down Do's and Don'ts

https://youtu.be/SZbh2Me4kq0

Simple Trading Strategy with CCI and Avg Down technique

https://youtu.be/w35_YtV4YQU

Simple trading strategy https://youtu.be/ibVzRwCX-3Q

Average Down Strategy https://youtu.be/RFCb5S78D8o

#bluechiptrading #sharetrading

-

9:24

9:24

Petes Investing

13 hours agoS&P500 & NASDAQ pushing up against RESISTANCE Likely Pullback

201 -

1:02:00

1:02:00

VINCE

3 hours agoThe Left's Demented Fantasies Shatter | Episode 117 - 09/03/25

135K64 -

59:34

59:34

Nikko Ortiz

1 hour agoPainful Military Fails

4.83K -

LIVE

LIVE

LFA TV

5 hours agoLFA TV ALL DAY STREAM - WEDNESDAY 9/3/25

4,653 watching -

LIVE

LIVE

MYLUNCHBREAK CHANNEL PAGE

3 hours agoHistory’s Most SHOCKING Claims?

643 watching -

LIVE

LIVE

Caleb Hammer

3 hours agoThe First LGBT Divorce On Financial Audit

100 watching -

DVR

DVR

Badlands Media

2 hours agoBadlands Daily: September 3, 2025 (#2)

15.8K1 -

LIVE

LIVE

Jim Jordan

2 hours agoEurope’s Threat to American Speech and Innovation

412 watching -

DVR

DVR

The State of Freedom

6 hours agoFLF: #16 Delivering the Truth Comes at a Cost w/ Joe Hoft

2.18K -

31:01

31:01

Rethinking the Dollar

2 hours agoWe're In A NEW Monetary Reality! Xi & Putin Knows How This ENDS | Morning Check-In: Let's Talk...

5.97K