Premium Only Content

Tyson Warns Input Prices Are Rising Faster Than They Can Raise, More Job Openings Than Unemployed

Grow At Home https://youtu.be/5JYjcYhnkOs

Subscribe to our backup channel

http://bit.ly/odyseesru

http://silverreportuncut.com

Subscribe to the SRU podcast

http://soundcloud.com/silverreport

http://silverreportuncut.podbean.com

Follow Us On Telegram http://t.me/silverreport & https://parler.com/profile/silverreport/posts

anyone can post on our public group http://t.me/silverreportforum

Ad revenue is down almost 70%, it's viewers like you who help keep the sru coming! you can donate via crypto at our website or consider supporting our work on

http://buymeacoffee.com/silverreport

https://www.patreon.com/silverreport

Tyson's CEO Donnie King said higher costs are hitting the firm faster than the company can lift prices, and retail prices are set to rise on Sept. 5.

King must have had a mental lapse during the earnings call because the word "transitory" was not part of the conversation.

Everything from fuel to labor to raw materials (corn and soybeans) to shipping to other inputs critical for livestock farming has exponentially risen over the last year.

not even the most optimistic whispers - was prepared for the shocking 10.073 million job openings that hit the tape at 10am ET sharp. This unprecedented number of job openings was made possible as more than 3.3 million openings were added in the past 6 months, with every single month of 2021 seeing an increase in job openings, the longest such stretch in history.

None of this should be a surprise as we've referenced two BofA reports that suggested "transitory" hyperinflation is not just ahead but has arrived.

In May, BofA said, "Buckle up! Inflation is here," and showed a chart of the number of mentions of "inflation" during earnings calls which exploded, more than tripling YoY per company so far, and the most significant jump in history since BofA started keeping records in 2004.

-

9:39

9:39

SRU

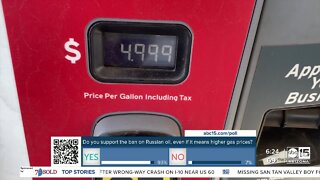

3 years ago $0.01 earnedFuel Prices Soar To Record High! Heating Fuel To Devastate America, Natural Gas Prices To Soar 32%

431 -

2:28

2:28

KJRH

3 years agoRising Gas Prices

1043 -

3:45

3:45

The Daily Caller

3 years agoFLASHBACK: Trump Warns Us About Gas Prices Rising Under Biden

9.29K16 -

59:25

59:25

American Center for Law and Justice

3 years agoGAS PRICES: NEW Democrat Plan Will Raise Prices MORE

7.31K48 -

1:47

1:47

KNXV

3 years agoRising gas prices may keep more people working remotely

43 -

1:55

1:55

WPTV

3 years agoWhat's causing rising gas prices?

954 -

2:02

2:02

WFTX

3 years agoEconomist warns panic buying of gasoline will raise prices in Southwest Florida

11 -

3:05

3:05

WEWS

3 years agoAddressing rising gas prices in Ohio

253 -

5:24

5:24

One America News Network

3 years agoBiden’s Gas Prices Just Keep Rising

83212 -

vivafrei

1 hour agoCBS News "Debunks" The Blaze Pipe Bomber Story? Thomas Massie Threatened by Kash Patel? AND MORE!

4.1K5