Premium Only Content

China Just Shut Down A Major Shipping Port, Record High PPI Shocks Investors, Margins Crushed

Subscribe to our backup channel

http://bit.ly/odyseesru

http://youtube.com/c/growathome

http://silverreportuncut.com

Subscribe to the SRU podcast

http://soundcloud.com/silverreport

http://silverreportuncut.podbean.com

Follow Us On Telegram http://t.me/silverreport & https://parler.com/profile/silverreport/posts

anyone can post on our public group http://t.me/silverreportforum

Ad revenue is down almost 70%, it's viewers like you who help keep the sru coming! you can donate via crypto at our website or consider supporting our work on

http://buymeacoffee.com/silverreport

https://www.patreon.com/silverreport

China just shut down what has been the worlds busiest shipping port. Chinese authorities on Wednesday closed a major container terminal at the Port of Ningbo after they claimed a dock worker became ill, raising fears among traders that supply chain disruptions that occurred when Yantian terminal in Shenzhen reduced output by 70% for a month earlier this summer would be repeated. We warned about this last week and it doesn't mean it's over for the other major ports, I would say it's only just begun.

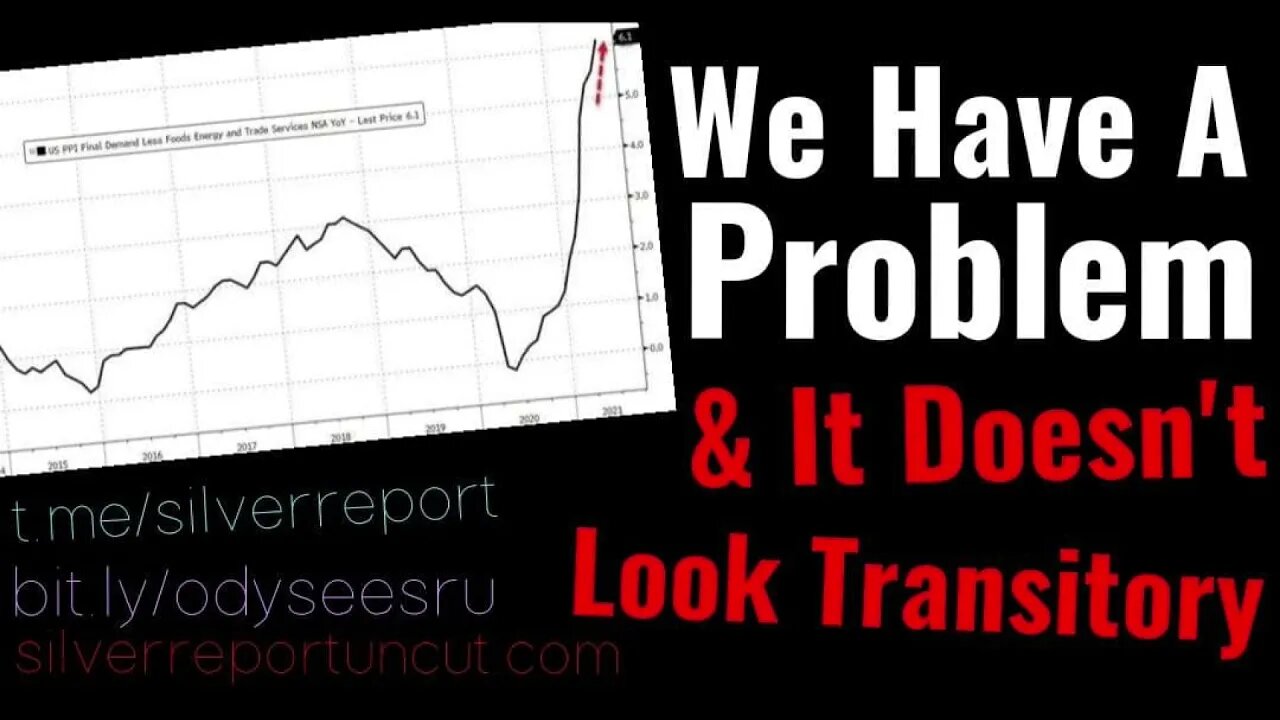

July's PPI soared to a new record +7.8% YoY up 1.0% MoM. The index for final demand services rose 1.1 percent in July, the largest one-month increase since data were first calculated in December 2009.

Services - Product detail: About 20 percent of the July advance in prices for final demand services can be traced to margins for automobiles and automobile parts retailing, which climbed 11.2 percent. The indexes for airline passenger services; hospital outpatient care; machinery and equipment wholesaling; traveler accommodation services; and securities brokerage, dealing, investment advice, and related services also increased. In contrast, prices for portfolio management fell 1.8 percent.

The index for final demand goods moved up 0.6 percent in July following a 1.2-percent jump in June.

Goods - Product Detail: Among prices for final demand goods in July, the index for tobacco products increased 2.7 percent. Prices for gasoline; diesel fuel; gas fuels; consumer, institutional, and commercial plastic products; and eggs for fresh use also moved higher. In contrast, the index for beef and veal fell 11.6 percent. Prices for residential electric power and for softwood lumber (not edge worked) also declined.

Nearly half of the broad-based advance in July is attributable to margins for final demand trade services, which jumped 1.7 percent. (Trade indexes measure changes in margins received by wholesalers and retailers.)

Core PPI (ex Food, Energy, & Trade Services) rose 0.9% MoM (almost double the expected pace of inflation) sending it up a record 6.1% YoY

-

16:33

16:33

SRU

2 years ago $0.06 earnedMy 5 Youtube Channels Stolen By Elon Worshipping Hacker Who Absorbed My Online Identity

6706 -

38:41

38:41

JohnXSantos

23 hours ago $0.56 earnedHow To Start A CLOTHING BRAND on a BUDGET! Step X Step (2025)

6.75K1 -

1:26:34

1:26:34

Man in America

19 hours agoExposing the Cover-Up That Could Collapse Big Medicine: Parasites

70.7K65 -

30:57

30:57

Her Patriot Voice

16 hours ago $15.61 earnedDemocrats More Unhinged Than EVER Before!

93.3K127 -

29:13

29:13

Clownfish TV

1 day agoGen Z are Becoming the Boomers?! | Clownfish TV

15.9K36 -

1:48:31

1:48:31

Squaring The Circle, A Randall Carlson Podcast

19 hours agoMEGA Tsunamis and the formation of our World ft. Dr. Dallas Abbot

31.2K7 -

29:26

29:26

Advanced Level Diagnostics

2 days ago $0.12 earned2019 Chevy Express - No Crank, Relay Clicking! Diag & Fix!

3.97K -

30:56

30:56

5AMPodcast

23 hours ago $0.20 earnedCitizen Journalism 🎙️Replacing Traditional Media | Sam Anthony on 5 AM Podcast

5.23K1 -

6:53

6:53

Rena Malik, M.D.

1 day ago $2.05 earnedWhy Antidepressants Wreak Havoc on Your Sex Life?! | Urologist Explains How to Boost your Libido

25.3K4 -

1:00:00

1:00:00

BEK TV

2 days agoMIKE MOTSCHENBACHER ON NORTH DAKOTA POLITICS, TEA PARTY ROOTS, AND THE 2026 ELECTION

18.9K