Premium Only Content

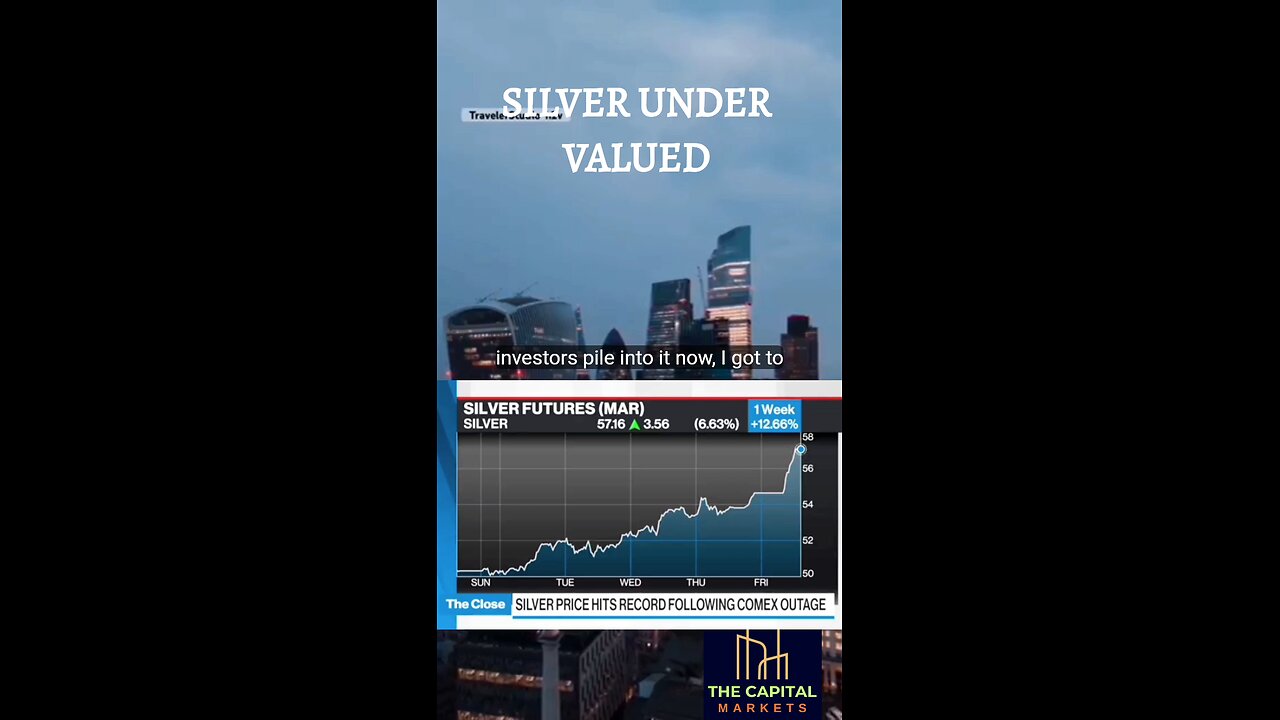

SILVER UNDER VALUED

Silver surged to a new all-time high—reaching around $56.50—amid a chaotic trading halt on the CME's Comex exchange due to a power outage, which fueled speculative rumors of physical silver shortages and triggered a retail-driven rally reminiscent of past short squeezes; this momentum was further supported by growing expectations of a Federal Reserve rate cut on December 10 (now priced in at 94% probability), which has boosted precious metals broadly. Meanwhile, in tech, Nvidia’s dominance is being challenged as companies like Google develop more energy-efficient, cheaper AI chips (such as their in-house TMUs), sparking investor skepticism about AI’s profitability and sustainability—particularly amid looming energy shortages that could bottleneck data center expansion, with Morgan Stanley warning of a 20% energy deficit over the next five years. While markets anticipate three Fed rate cuts through 2026, the pace may moderate depending on leadership changes at the Fed, and with current optimism largely priced in, further market moves may hinge on post-announcement Fed commentary.

https://linktr.ee/thecapmarkets

for coverage along with all the latest financial news and data!

#investing #finance #moneytips #personalfinance #stockmarket

#invest #longterm #stock #money #bitcoin #financialfreedom #ipo #ai #ev

Disclaimer: Trading in financial markets involves significant risk, and there is no guarantee of profit. The information provided by any financial product or service is for educational purposes and should not be considered as financial advice. Before making any investment decisions, it's important to conduct thorough research and consult with a qualified financial advisor. Past performance is not indicative of future results. Always invest what you can afford to lose and be aware of the potential for loss in any investment strategy.

-

2:55:01

2:55:01

TimcastIRL

7 hours agoTrump Calls Democrat RETARDED, Whistleblower EXPOSES Democrat FRAUD | Timcast IRL

226K65 -

LIVE

LIVE

Akademiks

6 hours agoMeg Thee Stallion spent $2 mil on lawyers to win $59k vs Milagro! 50 Cent BURIES Diddy. SNAKES HIM!

924 watching -

5:37:32

5:37:32

SpartakusLIVE

7 hours agoI'M BACK from Florida || The RETURN to the Spartan Stronghold

63.5K -

1:38:45

1:38:45

Joker Effect

5 hours agoWhy is everything so DIFFICULT?! Cuffem, Gypsy Crusader, WVAGABOND is getting SUED?! IDuncle is mad!

35.8K3 -

54:46

54:46

Flyover Conservatives

1 day agoInside the Kill Zones: Kidnappings, Camps & the War on Nigerian Christians Exposed - Judd Saul | FOC Show

34.6K1 -

1:02:35

1:02:35

MattMorseTV

7 hours ago $27.24 earned🔴We just got the CONFIRMATION.🔴

45.3K90 -

1:24:52

1:24:52

Glenn Greenwald

9 hours agoTrump Admin Preparing for New Regime-Change War Against Venezuela; Who Should Win Anti-Semite of the Year? See the Top 10 Finalists | SYSTEM UPDATE #551

123K88 -

23:12

23:12

Jasmin Laine

11 hours agoCBC TURNS on Carney—Poilievre Speech Goes VIRAL, ROASTS Canada’s Elites

32.4K17 -

1:16:21

1:16:21

The Daily Signal

10 hours ago $5.88 earned🚨BREAKING: Tim Walz Self-Destructs Over BILLIONS in Fraud Under His Watch, War Crime Allegations

28.4K8 -

9:08

9:08

China Uncensored

12 hours agoIndia And China Are Headed To Another War

12.3K11