Premium Only Content

Trump Brings Back the Financial Revolution

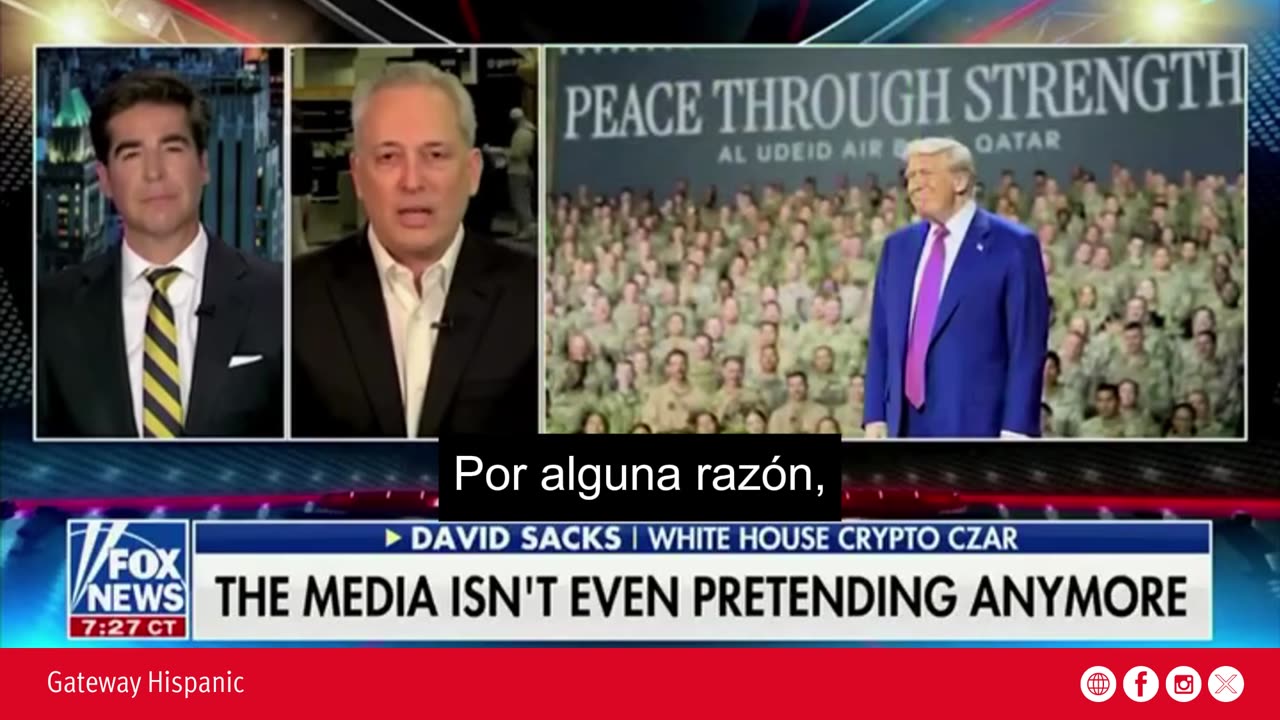

When David Sacks, tech entrepreneur and investor, made his bold statement on a national news broadcast saying, “This is the financial system of the future and we have to foster it,” he made clear what millions of innovators, entrepreneurs, and U.S. citizens already feel firsthand: the financial revolution is not only inevitable—it must happen on U.S. soil. But the most revealing part of his words wasn't his optimism about technology, but his direct accusation toward the obstacles imposed by the previous administration—particularly the covert role of Elizabeth Warren—and the contrast with the new leadership of Donald J. Trump in 2025.

The Silent Sabotage: Elizabeth Warren and the “Autopen” Era

It's no secret that the Biden administration, plagued by ideological figures like Elizabeth Warren, treated cryptocurrencies and financial decentralization with disdain. What’s surprising now, post-Biden, is how openly tech leaders are denouncing it. Sacks didn't hold back when he claimed that “she controlled the autopen” at the White House, making it clear that many of the decisions that paralyzed crypto innovation in the U.S. were directly driven by a radical anti-capitalist agenda.

The strategy was clear: suffocating regulation, legal threats, fear narratives about scams and money laundering, and a well-orchestrated media campaign to paint blockchain enthusiasts as “systemic risks.” But the real risk was something else: letting this trillion-dollar industry grow in Asia, Europe, or Latin America while the U.S. exiled itself from 21st-century economic leadership.

Trump and the Return of the U.S. Pioneer Spirit

In contrast, the new Trump administration has restored faith in the emerging financial ecosystem. With a clear vision of economic freedom, reduced regulatory burdens, and openness to private capital, President Trump has embraced the crypto world as a natural extension of U.S. philosophy: free markets, innovation, and individual ownership.

Under his leadership, the massive exodus of crypto companies that moved their headquarters to Dubai, Switzerland, and Singapore between 2021 and 2024 has reversed. Today, thanks to the positive signals sent from Washington, leading companies like Coinbase, Ripple, and dozens of startups are coming back. Not out of empty patriotism—but because there are now real reasons to build the financial future at home.

Crypto Isn’t Anarchy: It’s Efficiency, Transparency, and Sovereignty

Critics like Warren and her followers sold the narrative that cryptocurrencies threaten the financial system. But what’s really happening is an evolution toward a cheaper, more efficient, and most importantly, more transparent system. Public blockchains allow real-time audits, reduce transaction costs, and democratize access to capital. In a country where millions are excluded from the traditional banking system, crypto represents real inclusion.

As Sacks clearly stated, “we want all the innovation to happen here.” And this isn’t just a desire—it’s a geopolitical necessity. If the U.S. doesn’t lead the development of digital assets, China will. And while the Chinese Communist Party develops its fully surveilled digital yuan, the U.S. has a chance to prove that technology and freedom can coexist.

Latin America: A Region Ready for New Leadership

This transformation affects more than just the U.S.—Latin America is watching with attention and hope. In countries battered by inflation, banking corruption, and dollar dependence, the crypto world has become both a refuge and a tool for empowerment. From El Salvador—pioneering Bitcoin as legal tender—to digital communities in Argentina, Mexico, and Colombia, the southern region of the continent is ready to follow the example of a U.S. that embraces innovation.

What Trump offers the region is not just a new economic policy, but a symbol: that the leading country in the Western Hemisphere once again believes in technological potential as a driver of development. And that unlike the previous administration, it won’t punish those who create, experiment, and invest in new ways of doing finance.

The Time is Now: A New Economic Contract

The current push led by Trump doesn’t just save an industry—it redefines the role of the state in the modern economy. More than control, regulation, and punishment, what the crypto era needs is freedom, clear rules, and an opportunity mindset. The results of this vision are already being felt: new jobs, startups launched from garages to Wall Street, and a new generation that sees in blockchain not just speculation, but a future.

David Sacks said it with clarity and courage. Trump is making it possible. And history will remember who halted progress—and who ignited it.

Today, the message is clear: the financial future won’t wait. And thanks to President Trump, that future is being written here, in the United States.

-

2:16:35

2:16:35

BlackDiamondGunsandGear

11 hours agoEBT Apocalypse? / Snap Down SHTF / After Hours Armory

21.9K13 -

14:05

14:05

Sideserf Cake Studio

22 hours ago $16.69 earnedHYPERREALISTIC HAND CAKE GLOW-UP (Old vs. New) 💅

59.7K11 -

28:37

28:37

marcushouse

1 day ago $9.65 earnedSpaceX Just Dropped the Biggest Starship Lander Update in Years! 🤯

29.5K12 -

14:54

14:54

The Kevin Trudeau Show Limitless

3 days agoThe Hidden Force Running Your Life

113K26 -

2:16:35

2:16:35

DLDAfterDark

11 hours ago $10.00 earnedIs The "SnapPocalypse" A Real Concern? Are You Prepared For SHTF? What Are Some Considerations?

30.9K13 -

19:58

19:58

TampaAerialMedia

22 hours ago $10.16 earnedKEY LARGO - Florida Keys Part 1 - Snorkeling, Restaurants,

46.1K22 -

1:23

1:23

Memology 101

2 days ago $9.55 earnedFar-left ghoul wants conservatives DEAD, warns Dems to get on board or THEY ARE NEXT

36.4K75 -

3:27:27

3:27:27

SavageJayGatsby

12 hours ago🔥🌶️ Spicy Saturday – BITE Edition! 🌶️🔥

61.2K7 -

26:09

26:09

Exploring With Nug

22 hours ago $12.64 earned13 Cold Cases in New Orleans What We Discovered Beneath the Surface!

55.9K28 -

27:39

27:39

MYLUNCHBREAK CHANNEL PAGE

17 hours agoDestroying Time.

138K43