Premium Only Content

Weekend Edition 29: All Sorts of AI News, Financial Follow-up & More

WE 29.1 – Who Is Bob Metcalfe?

Ever heard of Bob Metcalfe? Not sure that I had, either, and I studied computing history back in the day. Well, Bob was a researcher at Xerox PARC (where the first GUI was developed, among many other computing firsts) back in the 1960s and 70s. He developed the Ethernet Standard in 1973 while working at PARC. He went on to found 3Com, which commercialized the standard, among other things. After that, he became a VC for a while, has taught at various universities, come up with other things, such as Metcalfe’s Law, and now he is developing simulations as a programmer, to find new things rather than to optimize current systems. Why am I talking about this guy? He was finally honored by the Association of Computing Machinery with the Turing Prize, which is more or less the Nobel Prize for computing. One would think that as ethernet finally replaced token ring systems for networking that this backbone of the internet would have netted Bob some accolades before now, but at least he was still alive to appreciate the honor.

https://www.cnet.com/tech/computing/50-years-later-creator-of-ethernet-wins-computings-top-prize/

WE 29.2 – Banking System on Thin Ice?

Last week we talked about the immediate fallout from the SVB and Signature Bank failures, tonight, we’re going to do a follow-up on that, as well as the Credit Suisse acquisition by UBS which was engineered by the Swiss authorities in order to save face with the world.

So, why did SVB fail, again? To understand that, we have to look at the big picture just as much as we need to look at the specifics of that bank. Ultimately, this is a sign of the whole system tottering. The whole fractional reserve banking/ Fed thing. If banks were required to hold in reserve an equivalent amount to that which they lend out, then these sorts of situations would never happen, as far as I can tell. Here’s how the macro picture pushed this over-leveraged bank over the edge into insolvency: for the better part of 20 years, the Fed has artificially (as if there is any other way that they could interfere) deflated interest rates and increased the money supply to match, so banks were able to get their hands on ever-increasing amounts of currency, particularly since ConVid overreactions “necessitated” making the money printers go “Brrrrrrr” almost 24/7 for almost 2 years. Then, all of the sudden, in the last year, the Fed spiked the rates through the roof, from .25% in February ‘22, all the way up to 4.75% last month. That is insane after the essentially free Fed money for the previous 4-5 years. This caught both SVB and Signature Bank off balance when enough of their depositors chose to request their money back all at once due to the Fed screwing with money supply in radical ways to “counteract inflation” and “prevent recession”. Right. Sure. Yeah, I’ll buy that. Now, the FDIC, which cleans up the messes from situations like this, and typically has buyers lined up for failed institutions like these, but is holding onto them for some reason this time, but apparently not due to any shortage of interested or qualified buyers. There have been several good offers from solid buyers, but the regulators at the FDIC have rebuffed all of them so far. Another trouble spot is that because pResident Depends promised that the FDIC (perhaps due to corruption by reason of the fact that many of the big name tech and real estate firms have been large and faithful donors to the Uniparty under the guise of the Democrats) would backstop all deposits, rather than simply the typically guaranteed $250,000 per depositor, as each bank had greater than 3/4 of their deposits beyond that covered amount. This sets the expectation for other banks, and the reality is that without We The People kicking in somehow, this whole system is going to fall to bits. THe difference between American deposits and what the FDIC has in its coffers for the insurance fund (which won’t even completely cover the deposits from SVB, by the way, not to mention Signature Bank, or any of the rest of the banks in the country) is nearly irreconcilable. The fund currently has $128 billion in it. American deposits total ~$17 trillion. SVB deposits totalled $173 billion, and Signature Bank added another ~$50 bilion to that total. How will they pay for this? Greater fees leveraged against the banks covered by the FDIC, and more loans from the Fed, of course. How will the banks recoup those fees? Why, by passing the costs onto us, in the form of higher fees and or lower interest rates, of course.

Sure, that doesn’t equate to more taxes, but it might as well.

Onto the Swiss situation... Credit Suisse failed just after SVB and Signature did. This 160 year old behemoth in the financial world had been struggling for years, to the tune of losing well over $100 billion in client business over the last 6 months. Prior to that, they had gone through 3 CEOs in 2 years. Last week, I reported that the Swiss Nat’l Bank was trying to prop CS up with $57 billion in loans to withstand the run that was underway after the bank’s largest shareholder refused to purchase more last week. The Swiss gov’t has more or less massaged UBS into taking over their fallen competitor, and they are rushing to get the deal completed, however, there are an enormous number of intricate moving pieces involved, as both banks were multinational. Therefore, every country where either one does business has to approve of the merger. All of this is very likely to gravely injure the Swiss standing as the premiere place for investment banking in the world. We will see how much damage the Khazarians can prevent from happening to their financial empire.

https://www.reuters.com/business/finance/credit-suisse-collapse-threatens-switzerlands-wealth-management-crown-2023-03-22/

https://www.reuters.com/business/finance/ubs-races-seal-credit-suisse-deal-soon-late-april-sources-say-2023-03-23/

WE 29.3 – AI Nonsense

Bard is now available for adult Google users to try out in the US and the UK. It has the advantage of being able to access realtime information to put together its answers to user prompts, where the primary competitor, ChatGPT, is stuck with old information. This may strike a blow at the considerable lead that OpenAI seems to have with their tool. Speaking of OpenAI, the CEO says that he is a bit afraid of what AI can do. However, to balance out the fearporn here, we have Fosco Marotto, the lead engineer at Gab, Inc. Gab, if you didn’t know, is a social platform based on the ideals of Free Speech, as enshrined in our constitution. Therefore, as long as a person does not make threats of bodily harm to another person or threats against the government, they are allowed to post whatever they wish. Along those lines, many hard right types have congregated there after being kicked off of mainstream social media platforms. With that milieu, you can imagine that the userbase there would be keenly interested in all things “based”, so when the CEO, Andrew Torba, started talking seriously about making a “based” AI tool, from generative text, to art, to movie clips. All that to say that Mr. Fosco knows what he is talking about when he explains that AI is extremely limited right now.

The fear mongering around the capabilities of AI and potential dangers is based on false assumptions and is done intentionally to gain power. There’s a lot of smoke and mirrors happening and the people in power really don’t want you to look behind the curtain.

That said, Mr. Altman (CEO of OpenAI) sounds more like he is desperately trying to manifest that which he speaks of, if Mr. Marotta is to be believed, and I tend to put more stock in that than in Altman’s little panic session in an interview with NBC. The key to all of this is to remember that AI is rightly understood as a tool that any who choose to use it are responsible to use well and use discretion to decide how and whether to use the results from that tool or not.

Baidu, the Chinese giant, has now released their AI chatbot, ERNIE, but not to fanfare and a bump in stock prices, as they showed a rather lackluster, pre-recorded presentation the other day to showcase what it could do. It is not a viable competitor for ChatGPT or Bard at this point.

Speaking of ChatGPT, they had their own bug crop up this last weekend. It was an error in one of their open source libraries which led to some users’ conversation titles being displayed to other users, but not the full conversations, just the titles. They took the service offline for a few hours on Monday, after it was discovered. As of the time of the writing of the article (Tuesday morning) the service was back nline, but they had turned off conversation histories until they squashed that bug.

Bing has added DALL-E to their implementation of ChatGPT embedded in their search engine (which is itself a rudimentary AI). Oh joy, now we can give Microsoft even more data. Sounds like a good time, guys and gals. NOT... Let’s have a chat about getting away from Big Tech, after all that is why I do this, to raise awareness of the need to undergo the pain and discomfort of breaking away and getting free from the trap of convenience that is presented by these Big Tech firms and their products, whether Windows & MS Office, or Google, or Apple, Meta, or Twitter. Not to mention Amazon, which I’ll be talking about next. If all patriots wake up and get away from Big Tech platforms and tools, those companies would collapse under their own bulk without half of the nation feeding them data all the time, they would have markedly fewer people to market to via ad deals with marketing firms. That is where the majority of the funding comes from: your data. If every freedom-minded business migrated away from Windows, Apple, and Alphabet, then those companies would start to shrivel and die. The economics of the moment already have them constricting to survive, but if all of us voted with our wallets by ceasing to use their products, they would be screwed. Let’s do this, people. Stick it to Big Tech, and stick it to The Man.

As an aside, the head of hardware development for Amazon is so far all in on FireTV that he has ditched his Echo that used to help him control his TV. He wants all Amazon customers to buy Alexa-enabled smart TVs because he is trying to make TVs more broadly useful, rather than being relegated to being off most of the time. He wants more data from us. It is that simple. I will never intentionally buy one. I think my family is migrating over to projectors anyway, so those will be connected with our network so that they can access our library and have dumb access to streaming services in the future. That simple. I wish I could quit Amazon, I really do. It’s so damned convenient, though.

https://www.cnbc.com/2023/03/20/openai-ceo-sam-altman-says-hes-a-little-bit-scared-of-ai.html

https://news.gab.com/2023/03/smoke-mirrors-and-fake-news-about-ai/

https://www.cnet.com/tech/services-and-software/microsofts-bing-adds-ai-image-creator-powered-by-dall-e/

https://www.bbc.com/news/technology-65018107

https://www.cnet.com/tech/services-and-software/chatgpt-bug-exposed-peoples-conversation-history/

https://www.cnn.com/2023/03/17/tech/baidu-stock-ernie-bot-intl-hnk

https://www.cnbc.com/2023/03/22/amazons-devices-head-ditched-echo-in-his-living-room-for-a-smart-tv.html

WE 29.4 – VPNs, Which One Should You Pick? The Fastest? The Most Private? The Most Secure? The One with the Best Features?

Well, this is all up to you, but according to CNet, the fastest VPN was Nord, by an 8% margin. The second fastest was ExpressVPN, but every year it seems that the ones they test (which seem to be the most popular ones in the US, perhaps) move up and down in the standings. Is speed enough to make you switch? I would argue that it shouldn’t be. What other aspects should matter? Customer service? Reliability? Being no-log? Having other bells & whistles? To me, the most important factors are no-log status, reliability, speed, customer service, then the rest. With that said, according to the findings of security.org, Nord is the best overall, and they tested 35 VPNs over the course of 6 months. They do note, however, that the support staff is very difficult to get ahold of for Nord, so while it is fast, secure, private, and reliable (along with being situated in a country outside of the Anglosphere spy networks), that is a significant downer there. Their top performers were Nord, SurfShark, Private Internet Access, UltraVPN, and the Norton offering.

I cannot speak to these, nor will I make any suggestions, other than to tell you that you need to research your VPN carefully before you pull the trigger. Make sure that they are well-rated across more than 2 websites, are strictly no-log, and reliable (both in terms of actually working consistently and not being able to respond to subpoenas because they have no data). What I will say is that you do need to make sure that you have a trustworthy DNS filter to catch Ads, malware, trackers, and anything else you don’t want to have access to on your computer. One such provider is ControlD, I currently use their filtering and it works great. I will link their free resolver down below.

https://www.cnet.com/tech/services-and-software/fastest-vpn/

https://www.security.org/vpn/best/

https://controld.com/free-dns

WE 29.5 – TikTok on the Hotseat

Yesterday, the CEO of TikTok testified before congress, and they didn’t take him seriously at alll. They seemed to have already made up their minds about the ban, but were giving him time in the theater to “plead his case”. You all know how I hate most social media by now, and have railed against TikTok for months, but I find myself not hating it so much now. I’ve researched it a bit more and they appear to be working their asses off to better protect the user data that they gather, which is a copious amount (in line with Meta & Twatter) nonetheless, but the primary concern that western governments seem to be having with it is the belief that “they’re sending all our data back to China”. They are literally spending billions between the US and Europe to house data from those regions in those regions. They are also developing strong policies of transparency around data handling to assuage everyone’s fears. However, it looks like because they aren’t directly tied to Western intelligence communities, the West is likely to ban it outright. I think the CIA, FBI, and other 5, 9, and 14 eyes countries are big mad that they don’t have a built-in back door to all that data, so if they can’t easily use it the way they have with American Big Tech products, then they don’t want us to have it. This is almost enough for me to want to jump on, just to fly the bird in the direction of the “powers that be”. However, I have other concerns, just as with any other social media platform, in terms of user privacy. I want to be able to control my data better. I also looked up some of the other anti-TikTok talking points I’ve been spouting since I started bashing them, and while their monetization for creators is a joke, they do legitimately have deals with major record labels and studios to use their content on the platform. Those are old deals which now only benefit TikTok, but oh well for the studios and labels. My concern over not honoring IP and copyrights is a non-issue. Forgive me for not looking into these issues any sooner. I will still not jump on, because I have enough tech stuff to keep me occupied until Jesus comes at this point. I need my brain and heart to be focused on what I need to do, not be fighting me to watch a never-ending stream of TikTok videos. That is the one issue that I don’t think that they could possibly address in a satisfactory way, though they have rolled out speed bumps for minors on the platform, even if they are easy to bypass. That is something that is unique in social media. Props to them.

I am conflicted. My hardline hot takes have been overkill, guys and gals. I still do not like it, but most of my talking points, after seeing what they have been working on, seem at the very least out of date, if not dead wrong. Forgive me for feeding the hysteria. For me, in terms of data, it is primarily a question of proof being in the pudding. They can say that they are and have been working hard to improve and change, but unless multiple independent auditors are engaged and find that it is all true, over time, the concern still stays. They are a growing platform, so perhaps their creator monetization issues will be remedied over time as their position becomes stronger. I do not feel sorry for the record labels and studios who are whining about not getting a bigger cut of the ad revenue pie. The addiction issues and other related problems, I am unsure if can be addressed fully. It is the nature of the platform to incentivize more user attention, and kids dying while attempting dangerous challenges is sad and terrible, but perhaps that is a good reason why kids shouldn’t be allowed on the platform at all. They lack the brain development to handle that.

https://www.cnn.com/2023/03/23/tech/tiktok-ceo-hearing

https://fortune.com/2022/11/08/tiktok-profits-record-industry-wants-increase-royalties-revenue/

https://www.businessinsider.com/how-much-tiktok-pays-for-views-real-examples-pulse-creator-fund

-

1:10:04

1:10:04

We The Free News

1 month agoWe The Free News Ep 21: Guess Who's Back...

99 -

DVR

DVR

In The Litter Box w/ Jewels & Catturd

20 hours agoFANI IN DEFAULT | In the Litter Box w/ Jewels & Catturd – Ep. 703 – 12/11/2024

14.8K8 -

3:21:08

3:21:08

Viss

4 hours ago🔴LIVE - Dominating The Delta Force Arena! - Delta Force Extractions

5.32K2 -

17:41

17:41

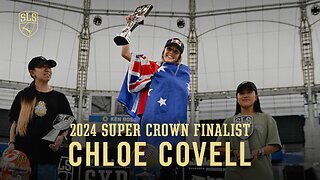

SLS - Street League Skateboarding

4 hours agoSuper Crown Finalist: Chloe Covell | Best of the 2024 SLS Championship Tour, so far…

2.29K -

LIVE

LIVE

Mally_Mouse

1 hour agoLet's Yap About It - LIVE!

494 watching -

LIVE

LIVE

Film Threat

7 hours agoJUSTINE BATEMAN SPEAKS! LIVE INTERVIEW | Hollywood on the Rocks

213 watching -

4:02

4:02

Guns & Gadgets 2nd Amendment News

1 hour agoBREAKING NEWS: FBI Director RESIGNS

119 -

11:24

11:24

Dr David Jockers

1 hour agoHow High Blood Sugar Destroys Your Arteries & How To Fix It

-

LIVE

LIVE

StoneMountain64

3 hours ago1st person FORTNITE is here.

242 watching -

1:46:40

1:46:40

The Pat Bev Podcast with Rone

5 hours agoWhat's Wrong the the Eastern Conference & How Do the Lakers Save Their Season? Ep. 113

3.51K