Superannuation Explained With Example | MAXIMIZE your gain with a SIMPLE trick

00:00 - Intro

00:37 - What is superannuation in Australia explained

02:10 - Why should you consider super contribution

04:19 - How much do you need?

05:11 - How a small contribution can make a big difference (example)

08:11 - How to maximise your gain

10:08 - The early retirement and reward of super investment

Discover the ultimate wealth-building secret for Australians! In this must-watch video, we unveil the power of superannuation and how it can pave the way to financial prosperity, even for the average Aussie. Learn how a single strategy can potentially lead to millions in savings, transforming your retirement dreams into reality. With clear explanations and practical insights, we'll guide you through the workings of superannuation and unveil one simple trick that could supercharge your wealth journey.

Unveil the key to maximizing your superannuation benefits and securing a comfortable retirement. As we delve into the mechanics of super contributions, tax advantages, and investment returns, you'll gain invaluable knowledge that can reshape your financial future. Whether you're just starting your career or nearing retirement age, this video offers essential tips to harness the full potential of your superannuation fund.

Don't miss out on this opportunity to take control of your financial destiny! Join us as we reveal how ordinary Australians can leverage superannuation to accumulate wealth over time. With a clear understanding of the concessional contribution cap and smart investment strategies, you can embark on a journey towards financial freedom. Watch now and unlock the secret to making millions with superannuation, empowering yourself to live the life you've always dreamed of.

Superannuation, Retirement planning, Wealth building, Financial advice, Investment strategies, Tax advantages, Australian finance, Personal finance, Retirement savings, Financial education, Financial literacy, Money management, Retirement funds, Saving for the future, Compound interest, Super fund, Retirement accounts, Financial planning, Wealth management, Savings strategies, Tax planning, Retirement income, Investment opportunities, Australian economy, Budgeting tips, Financial independence,

#Superannuation #RetirementPlanning #WealthBuilding #FinancialAdvice #InvestmentStrategies #TaxAdvantages #AustralianFinance #PersonalFinance #RetirementSavings #FinancialEducation #FinancialLiteracy #MoneyManagement #RetirementFunds #SavingForTheFuture #CompoundInterest #SuperFund #RetirementAccounts #FinancialPlanning #WealthManagement #SavingsStrategies #TaxPlanning #RetirementIncome #InvestmentOpportunities #AustralianEconomy #BudgetingTips #FinancialIndependence

Sources:

Income Tax Calculator

https://moneysmart.gov.au/work-and-tax/income-tax-calculator#!focus=1

Example: annual minimum pension payment

Table 11: Minimum percentage factor for certain pensions and annuities (indicative only) for each age group

Table 10: Untaxed plan cap amount

Tell us about yourself so we can estimate your super balance at retirement

https://www.australiansuper.com/tools-and-advice/calculators/super-projection-calculator

Detailed Retirement Expenditure Breakdowns

https://www.superannuation.asn.au/resources/retirement-standard/

-

16:28

16:28

Peak Prosperity

21 days agoThe Hidden Risks of Derivatives - A Peak Prosperity Clip

5.4K1 -

38:17

38:17

FGP

1 month ago💰 Profit Maximization & Tax Optimization: Insights From A Financial Expert 💼

341 -

24:12

24:12

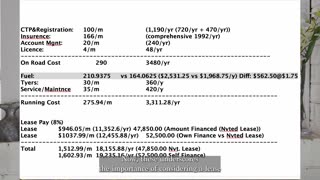

Crixus

24 days agoWhat is a Novated Lease? How to calculate Pre & Post Tax Deductions Accurately to Maximize Benefits

291 -

33:35

33:35

REIMastermindNetwork

2 months agoMax Out Your Passive Income with These Annuity Hacks w/ Mark Willis

10 -

33:44

33:44

REIMastermindNetwork

1 month agoMaximize Returns: The Power of 1031 Exchanges Revealed w/ Dave Foster

7 -

12:11

12:11

LisaJStocks

4 months agoMaximize Your Tax Return: Invest, Don't Spend! 📈

18 -

20:20

20:20

Peak Prosperity

1 month agoFrom Vulnerability to Security: Crafting a Resilient Retirement Plan

1.91K1 -

12:14

12:14

Investor Financing Podcast

4 months agoMaximize Your Business Growth: Beau Eckstein's Guide to Mastering SBA 7A Refinance Options!

6 -

1:02:43

1:02:43

Peak Prosperity

1 month agoBiden’s Massive Cap Gains Tax Hike, The Yen, And Investing - Peak Prosperity

1.74K4 -

3:37

3:37

Dr. Anthony M. Criniti IV (aka “Dr. Finance®”)

2 months agoFINANCE EDUCATOR ASKS: How to Make Real Money Selling Books: Top Book Sales Expert Reveals Secrets

233