Market Valuation Series Part 6: Interest Rate Model

My Exclusive Free Workshop The Four P's of Building a Successful Investing Program → https://spxinvesting.mailchimpsites.com

Blog: https://spxinvestingblog.com

https://www.facebook.com/groups/433843641082343

https://www.multpl.com/sitemap

https://www.currentmarketvaluation.com/

Videos Referenced:

Stock Market Valuation Video Series Part 1 Miltpl.com: https://youtu.be/y0BxSkpJotA

Stock Market Valuation Video Series Part 2 The Shiller PE Ratio: https://youtu.be/3VNCA89kWDo

Stock Market Valuation Series Video Part 3 The Yield Curve Model: https://youtu.be/5Vo9OfMuAss

Stock Market Valuation Series Video Part 4 Buffett Indicator Model: https://youtu.be/5Vo9OfMuAss

Stock Market Valuation Series Video Part 5 The S&P 500 Mean Reversion Model: https://youtu.be/n8416dQj454

Is the Stock Market Getting Ready to Crash? https://youtu.be/F4VUuOBy4mc

S&P 500 P/E Ratio Valuation Update August 1, 2021: https://youtu.be/9f3JSj0EpUY

Mutual Funds: https://youtu.be/hRip-z93PI0

ETFs: https://youtu.be/N_Dk1yn-mxs

Moving Averages and Oscillators: https://youtu.be/ge0KiCIjpzE

Stock Market Valuation Part 6: The Interest Rate Model

Tools can be used to determine if the stock market is:

Overvalued: Expensive

Undervalued: Cheap

Fairly Valued: Just about right

Interest Rates

Some investors buy bonds in order to receive interest payments (Risk-Off).

However, US interest rates are currently at, or near, all-time lows.

This makes bonds less attractive.

In order to obtain potentially higher returns, investors buy stocks which are considered riskier (Risk-On).

Buying stocks helps keep stock prices at current levels as well as push prices higher.

As of September 10, 2021, Current Market Valuation has measured that compared to interest rates, the S&P 500 (SPX) is Fairly Valued.

Conflict?

Does interest rates rising or falling impact stock prices?

Research done by The SPX Investing Program shows that stocks tend to rise with Interest rates.

Other research indicates that stocks tend to fall as interest rates rise and vice versa.

Both are correct.

The environment dictates this relationship.

There are periods when stocks and bonds move in tandem and other times when they are inversely correlated.

Conclusion

The S&P 500 Value Relative to the Interest Rate Model posted by the Current Market Valuation website is Fairly Valued.

Other Stock Market Valuation measurements show that the S&P 500 is OVERVALUED.

No immediate action is necessarily warranted.

However, it is necessary to have a plan developed and in place in case the market environment changes.

If other measurement tools suggest a major change in trend (up to down) implementing a plan will be in order for:

Those who have only long positions (defensive).

Those who participate in short positions (offensive).

-

21:37

21:37

The SPX Investing Program

2 years ago $0.09 earnedMarket Valuation Series Part 1: Multpl.com

194 -

18:27

18:27

The SPX Investing Program

2 years ago $0.20 earnedMarket Valuation Series Part 2: Shiller PE Ratio

247 -

9:39

9:39

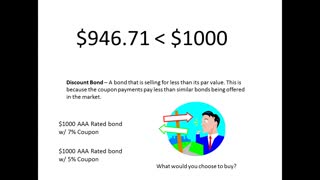

Subjectmoney.com

3 years agoHow to Price/Value Bonds - Formula, Annual, Semi-Annual, Market Value, Accrued Interest

65 -

3:53

3:53

Real Estate Agent In Maryland

1 year agoHousing market interest rate

-

8:05

8:05

RicBender

2 years agoReal Estate Market : Should You Get An Adjustable Rate Mortgage?

11 -

4:37

4:37

stuartwelch

1 year agoInterest Rates are RISING! How will this impact the market?

14 -

12:48

12:48

Sergej Steffensen

4 months agoInvesting in Real Estate 101: Understanding the 6 Factors on Required Rate of Return

15 -

2:41

2:41

Sacramento Metro Real Estate

10 months agoReal Estate Market Forces Model©

12 -

6:22

6:22

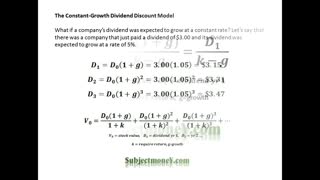

Subjectmoney.com

3 years agoDividend Discount Model (DDM) - Constant Growth Dividend Discount Model - How to Value Stocks

1.91K1 -

0:52

0:52

dandantheinsuranceman

10 months agoWhat do you mean by Compounding Interest?

11