Premium Only Content

More About "Choosing Between Traditional vs Roth IRAs for Your Retirement Savings"

https://rebrand.ly/Goldco2

Join Now

More About "Choosing Between Traditional vs Roth IRAs for Your Retirement Savings", retirement investing basics

Goldco helps customers safeguard their retirement savings by surrendering their existing IRA, 401(k), 403(b) or other professional pension to a Gold IRA. ... To learn exactly how safe haven rare-earth elements can help you build and also safeguard your riches, as well as even protect your retirement phone call today retirement investing basics.

Goldco is among the premier Precious Metals IRA companies in the United States. Secure your riches as well as source of income with physical precious metals like gold ...retirement investing basics.

Opting for Between Traditional versus Roth IRAs for Your Retirement Savings

When it happens to saving for retirement, one of the most typical options readily available to individuals is an Individual Retirement Account (IRA). An IRA is a type of investment profile that offers tax obligation perks for retired life savings. There are actually two major styles of IRAs: traditional and Roth. Each has actually its very own set of rules and perks, so it's vital to know the variations between the two before creating a selection.

Traditional IRA:

A conventional IRA is a retired life financial savings profile that makes it possible for people to contribute pre-tax profit in to their account. This implies that contributions helped make to a standard IRA can easily be subtracted coming from your taxable profit for the year in which they are helped make. This can easily lead in instant income tax savings as you are decreasing your taxed earnings.

One of the crucial perks of a conventional IRA is that your earnings grow tax-deferred until you start making drawbacks during retired life. This implies that any kind of financing gains, dividends, or enthusiasm earned within the profile are not subject to income taxes until they are removed.

Nonetheless, once you arrive at grow older 72, you will certainly be required to start taking minimum circulations from your traditional IRA. These required minimal circulations (RMDs) are figured out located on your grow older and profile harmony and should be taken each year afterwards. The amount withdrawn is at that point topic to normal revenue tax prices at that time.

An additional aspect worth thinking about along with a conventional IRA is that contributions helped make might be tax-deductible if specific standards are fulfilled. Nevertheless, if you or your husband or wife has actually access to an employer-sponsored retirement life plan such as a 401(k), the tax rebate limits might apply based on your changed adjusted gross earnings (MAGI).

Roth IRA:

On the other hand, a Roth IRA functions in a different way coming from its standard equivalent. Additions produced to a Roth IRA are carried out along with after-tax dollars, suggesting they do not offer any type of immediate tax obligation reductions like those given by a conventional IRA.

While you do not get any kind of income tax deductions for your contributions, the primary conveniences of a Roth IRA is that your earnings grow tax-free. This means that as long as you meet certain requirements, you will certainly not owe any sort of tax obligations on the growth of your investments when you withdraw them during the course of retirement.

Furthermore, a Roth IRA does not have required minimal circulations (RMDs) throughout the account owner's life-time. This may be useful for individuals who have various other resources of earnings and do not really want to be forced into taking drawbacks from their retirement life savings.

Another benefit of a Roth IRA is that it enables for better flexibility when it comes to accessing your payments. Unlike a traditional IRA, you can withdraw your authentic additions at any time without charge or tax obligations. Having said that, removing any earnings prior to grow older 59 ½ might lead in penalties and income taxes.

Which one is right for you?

Selecting between a typical and Roth IRA depends on your individual circumstances and monetary targets. Below are some elements to think about:

1. Existing vs Future Tax Rates: If you assume your income tax fee to be much higher in retired life than it presently is, a Roth IRA might produce more feeling as it allows for tax-free withdrawals later on. On the various other palm, if you anticipate being in a lower income tax bracket d...

-

9:21:38

9:21:38

Dr Disrespect

16 hours ago🔴LIVE - DR DISRESPECT - UNBELIEVABLE WARZONE CHALLENGES

219K15 -

1:40:10

1:40:10

AimControllers

8 hours ago $5.98 earned🔴LIVE - THE PRE GAME LOBBY PODCAST Ep. 2

39.5K2 -

19:19

19:19

Actual Justice Warrior

11 hours agoAna Kasparian DESTROYS Los Angeles Democrats

46.8K18 -

44:12

44:12

Ohio State Football and Recruiting at Buckeye Huddle

10 hours agoIs Order Finally Being Restored to College Football?

35.4K -

9:11

9:11

Faith Frontline

10 hours agoWatch Alan Ritchson EXPOSE Hollywood’s Atheism With Jesus

38.8K20 -

4:29:52

4:29:52

VOPUSARADIO

1 day agoPOLITI-SHOCK! "DESTROY THE NARRATIVE & EXPOSE THE FRAUDS" W/ Special Guest Timothy Shea

37.7K -

1:24:25

1:24:25

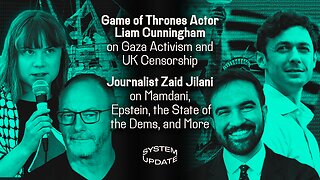

Glenn Greenwald

10 hours agoGame of Thrones Actor Liam Cunningham on Gaza Activism and UK Censorship; Journalist Zaid Jilani on Mamdani, Epstein, the State of the Dems, and More | SYSTEM UPDATE #484

144K45 -

2:48:13

2:48:13

Nikko Ortiz

10 hours agoGas Station Shooting Gone Wrong

70.1K9 -

1:45:00

1:45:00

RiftTV

9 hours agoBETRAYAL: Bondi Persecutes HERO DOCTOR Under Trump DOJ | The Rift | Marc Lobliner & Lilly Gaddis

47.3K22 -

7:29:03

7:29:03

RalliedLIVE

14 hours ago $5.50 earnedSHOTTY BOYS vs TRIPLE THREAT THURSDAY

75.2K2