Is A Financial Advisor A Benefit For My Financial Freedom?

#financial #financetips

So, what is a financial advisor? Essentially, a financial advisor is a professional who helps you manage your money and make sound financial decisions.

They can provide a wide range of services, from creating a financial plan to helping you invest your money.

When working with a financial advisor, it's important to understand how they work. A good financial advisor will take the time to get to know you and your financial goals, and then create a plan tailored specifically to your needs. They should be knowledgeable about a variety of financial products and be able to explain them in a way that you can understand.

One of the biggest benefits of working with a financial advisor is that they can help you achieve your financial goals. Whether you're saving for retirement, paying off debt, or investing for the future, a financial advisor can help you develop a plan to get there.

When looking for a financial advisor, there are a few important things to keep in mind. First, make sure they have the right credentials and experience to provide the services you need. Look for certifications like Certified Financial Planner (CFP) or Chartered Financial Analyst (CFA).

Secondly, it's important to find a financial advisor who is a good fit for you. You'll be working closely with this person, so you want to make sure you feel comfortable with them and their approach.

As for cost, financial advisors typically charge a fee for their services. This can be a flat fee, hourly rate, or a percentage of your assets under management. The cost can vary widely depending on the services provided and the advisor's experience.

Now, let's answer some of the most common questions people have about financial advisors:

1. What is the difference between a financial advisor and a financial planner? The financial advisor typically provides investment advice and manages portfolios, while a financial planner takes a more holistic approach to a client's financial situation, including budgeting, retirement planning, estate planning, and tax planning. Financial planners often work with clients to create a comprehensive financial plan that encompasses all aspects of their financial life, while financial advisors focus more on managing investments and optimizing returns. However, the lines between these two roles can sometimes blur, and many professionals use the titles interchangeably. It's important for clients to understand the specific services a financial professional provides before engaging their services to ensure they are receiving the appropriate level of advice and planning for their unique financial situation.

2. Can a financial advisor help me with my taxes? A financial advisor can certainly help you with your taxes. They can provide valuable guidance on tax planning and strategies to minimize tax liabilities. Additionally, many financial advisors work in conjunction with tax professionals to ensure their clients are taking advantage of all available tax benefits.

One of the key tax benefits that financial advisors can help their clients with is retirement planning. Contributions made to certain retirement accounts, such as traditional IRAs and 401(k)s, can be tax-deductible, reducing taxable income for the year. Financial advisors can help clients determine how much to contribute to these accounts to maximize the tax benefits.

Another tax benefit that financial advisors can assist with is charitable giving. Donations made to qualified charitable organizations can be tax-deductible, reducing taxable income. Financial advisors can help clients identify charitable organizations that align with their values and goals while also providing tax benefits. Additionally, financial advisors can assist with tax-loss harvesting. This involves selling investments that have declined in value to offset gains in other investments, thereby reducing taxable income. Financial advisors can help clients navigate the tax rules around loss harvesting and identify opportunities to implement this strategy.

DISCLAIMER: This video does not provide investment or economic advice and is not professional advice (legal, accounting, tax). The owner of this content is not an investment advisor. Discussion of any securities, trading, or markets is incidental and solely for entertainment purposes. Nothing herein shall constitute a recommendation, investment advice, or an opinion on suitability. The information in this video is provided as of the date of its initial release. The owner of this video expressly disclaims all representations or warranties of accuracy. The owner of this video claims all intellectual property rights, including copyrights, of and related to, this video.

Copyright © 2023 Finance Five, All rights reserved.

-

38:24

38:24

Tucker Carlson

4 hours agoTucker Carlson and Donald Trump Jr. Respond to the Trump Verdict

34.1K254 -

2:01:47

2:01:47

Fresh and Fit

4 hours agoAfter Hours w/ & Tommy Sotomayor

103K188 -

34:19

34:19

Alexis Wilkins

10 hours agoBetween the Headlines with Alexis Wilkins: The Verdict and More

27K29 -

1:11:21

1:11:21

Kim Iversen

10 hours agoWW3?!? Is The West Secretly Behind Another Color Revolution Aimed At Toppling Russia? | Biden Maniacally Bombs Yemen and Russia

65.3K55 -

1:36:46

1:36:46

Roseanne Barr

8 hours agoFor Love of Country with Tulsi Gabbard | The Roseanne Barr Podcast #50

77.3K121 -

33:59

33:59

TudorDixon

15 hours agoA Story of Sacrifice and Service with Joe Kent | The Tudor Dixon Podcast

25.7K4 -

27:22

27:22

The Nima Yamini Show

7 hours agoAlpha Nima Crushes Nick Fuentes & Business Tips with Dylan

21.4K14 -

1:19:23

1:19:23

Mally_Mouse

6 hours agoLet's Hang - Cosplay Stream!!

38.4K1 -

1:05:06

1:05:06

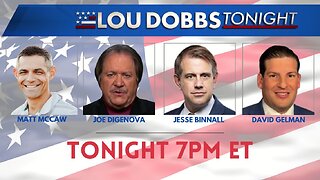

Lou Dobbs

13 hours agoLou Dobbs Tonight 5-31-2024

53.1K32 -

1:42:57

1:42:57

The Quartering

13 hours agoDonald Trump Conviction BACKFIRES, Massive Funds Raised, Democrats Swap Parties & More

88.8K94