How I Earned $700 per day From Day Trading 😎

Welcome to My Rumble trading channel! I provide straightforward and practical trading insights for both beginners and experienced traders. Join me as I explore various markets, share trading strategies, and provide educational content to help you succeed in the world of trading. Subscribe now and elevate your trading skills with my valuable tips and analysis. Let's navigate the markets together and achieve financial success!

DISCLAIMER : Trading involves significant risk, and past performance is not indicative of future results. My content is for educational purposes only and should not be considered financial advice, Always conduct thorough research and consult with a qualified financial professional before making any investment decisions. All links provided on this channel are either affiliate links or personal website's.

==================================================

INSTAGRAM : https://www.instagram.com/anonymoustrader365/

TikTok : https://www.tiktok.com/@anonymoustrader365?_t=8dI7YOP0I9L&_r=1

==================================================

#trending #trading #daytrading #scalping #shorts #Stocks #Bonds #Options #Futures #Forex (Foreign Exchange) #Commodities #Cryptocurrency #Trading platform #Brokerage #Market analysis #Technical analysis #Fundamental analysis #Day trading #Swing trading #Long-term investing #Margin trading #Stop-loss order #Take-profit order #Candlestick chart #Moving average #Support and resistance #Bull market #Bear market #Volatility #Liquidity #Market order #Limit order #Bid #Ask #Volatility index (VIX) #Risk management #Diversification #Portfolio #Short selling #Margin call #Trading psychology #Economic indicators #Earnings reports #Market trends #Insider trading #Algorithmic trading #Derivatives #Market manipulation #Position sizing #Market liquidity #Market maker #RSI (Relative Strength Index) #MACD (Moving Average Convergence Divergence) #Breakout #Breakdown #Trend line #Fibonacci retracement #Risk-reward ratio #Intraday trading #Penny stocks #Blue-chip stocks #Dividends #Initial Public Offering (IPO) #Market capitalization #Market sentiment #Technical indicators #Stock exchange #Volatile market #Market order #Buy order #Sell order #Bullish #Bearish #Day trader #Swing trader #Scalping #High-frequency trading #Options trading strategies #Puts #Calls #Option premium #Option chain #Option expiration #Strike price #Implied volatility #Volatility skew #Volatility smile #Market depth #Bid-ask spread #Market volatility #Market timing #Position trading #Swing high #Swing low #Moving average crossover #Volume analysis #Relative strength #Moving average convergence divergence #Candlestick patterns #Head and shoulders #Double top #Double bottom #Cup and handle #Ascending triangle #Descending triangle #Pennant #Flag #Shooting star #Doji #Hammer #Bullish engulfing #Bearish engulfing #Support level #Resistance level #Bull trap #Bear trap #Stop order #Limit order #Market order #Buy limit order #Sell limit order #Buy stop order #Sell stop order #Entry point #Exit point #Trailing stop #Breakout trading #Momentum trading #Trend trading #Range trading #Chart patterns #Moving average ribbon #Bollinger Bands #Stochastic oscillator #Relative strength index #Fibonacci retracement levels #Elliot Wave theory #Stock split #Stock dividend #Dividend yield #Dividend payout ratio #Earnings per share #Price-earnings ratio #Return on investment #Margin requirements #Financial leverage #Slippage #Volatility trading #Event-driven trading #News trading #Gap trading #Arbitrage #Scalping #Market cycle #Fundamental analysis #Technical analysis #Sentiment analysis #Order flow analysis #Seasonality #Market efficiency #Market anomaly #Trading strategy #Risk tolerance #Trading plan #Backtesting #Forward testing #Stop-loss order #Take-profit order #Trailing stop-loss #Profit target #Risk-reward ratio #Position sizing #Money management #Trading journal #Trading simulator #Market order #Limit order #Stop order #Day order #Good-till-cancelled order #Fill or kill order #Immediate-or-cancel order #Pre-market trading #After-hours trading #Dark pool trading #Margin account #Cash account #Short squeeze #Long squeeze #Market manipulation #Slippage #Volatility breakout #Gap trading #Swing high #Swing low #Moving average crossover #Volume analysis #Relative strength #Moving average convergence divergence #Moving average envelope #Momentum oscillator #RSI divergence

-

8:12

8:12

SniperTrader

4 months agoWhat Not to Do | Day Trading

28 -

6:05

6:05

SniperTrader

3 months ago2 Days Trading Recap $5200 Bucks Profit

22 -

0:44

0:44

Ticcs

6 months agoday trading is the easiest way to make money on bitcoin crypto

126 -

8:29

8:29

Master Your Money: Unleash Your Financial Potential

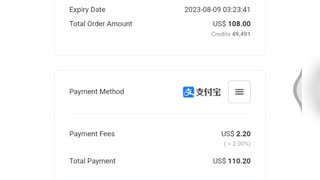

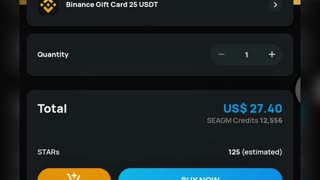

9 months agoMake Money Trading Binance Gift Cards | Make Money with Paypal Arbitrage | Online Income Guide | PT2

37 -

0:48

0:48

BeachBumTrading

4 months agoWhat is Day Trading

101 -

11:43

11:43

BeachBum Trading

4 months agoMake Money Trading in September

22 -

10:29

10:29

Master Your Money: Unleash Your Financial Potential

9 months agoMake Money Trading Binance Gift Cards | Make Money via Paypal Arbitrage | Online Income Guide 2023

38 -

22:50

22:50

We Profit with Stock Curry

8 months agoWhy is the Stock Market Down Today | How We Made Money

1.64K5 -

33:36

33:36

Grok Trade

1 year agoStock Market Analysis by Trader w/ 24yr Trading Experience

26 -

5:24

5:24

DayTradeToWin

2 years agoTrading Price Action - Only Way To Succeed for Day Traders

42