"Diversifying Your Portfolio with Gold: Exploring the Potential of Gold Rate Investing" Fundame...

https://rebrand.ly/Goldco6

Join Now

"Diversifying Your Portfolio with Gold: Exploring the Potential of Gold Rate Investing" Fundamentals Explained, gold rate investing

Goldco assists clients protect their retirement financial savings by rolling over their existing IRA, 401(k), 403(b) or other competent retirement account to a Gold IRA. ... To find out how safe haven rare-earth elements can assist you construct as well as shield your wealth, and also safeguard your retired life telephone call today gold rate investing.

Goldco is one of the premier Precious Metals IRA business in the United States. Shield your wide range and also livelihood with physical rare-earth elements like gold ...gold rate investing.

Understanding the Current Gold Rate and its Impact on Expenditures

Gold has been a beneficial and sought-after possession for centuries. It is taken into consideration a secure place expenditure, particularly throughout times of economic anxiety. Lots of capitalists switch to gold as a method to secure their riches and bush against inflation. The cost of gold is influenced by a variety of elements, featuring source and need dynamics, geopolitical tensions, passion rates, and the overall health of the worldwide economic situation.

In latest years, the rate of gold has experienced considerable changes. Understanding the current gold fee and its impact on financial investments is important for people who are taking into consideration incorporating gold to their expenditure profile.

The current gold rate recommends to the cost at which gold is being traded in the market. This price is determined through numerous factors. One of the primary motorists of the gold cost is source and requirement dynamics. The mining creation amounts, core bank plans on gold books, fashion jewelry requirement, and entrepreneur conviction all play a critical task in determining the supply and requirement for gold.

Geopolitical tensions additionally impact the existing gold cost. In the course of times of political vulnerability or uncertainty, investors usually gather to safe-haven possessions like gold. This raised requirement frequently leads to an rise in the rate of gold.

Interest rates possess an inverted partnership with the rate of gold. When rate of interest costs are reduced or negative, it lowers the possibility expense of holding non-yielding possessions like gold. As a end result, financiers tend to allot more funds in the direction of purchasing gold, driving up its rate.

The health and wellness of the worldwide economic condition likewise participates in a considerable task in establishing the existing gold cost. In the course of time frames of financial downturns or economic slumps when sell markets are volatile or experiencing considerable downtrend, investors often turn to safe-haven possessions like gold as they strongly believe it will retain its worth a lot better than other financial investments.

The influence that changes in the existing gold cost have on expenditures can easily vary relying on personal circumstances and financial investment objectives. For some capitalists, having bodily gold such as gold coins or bars offers a feeling of safety and security and functions as a long-term store of value. Others may prefer to spend in gold exchange-traded funds (ETFs) or gold mining stocks.

Putting in in bodily gold can easily behave as a hedge versus rising cost of living. Rising cost of living erodes the investment power of fiat currencies, but since gold is a tangible resource along with intrinsic worth, it tends to hold its market value over time. By possessing physical gold, entrepreneurs can shield their riches from the effect of rising costs.

Gold ETFs are an additional well-known expenditure alternative for those appearing to obtain visibility to the price action of gold without actually owning it. These ETFs commonly track the price of gold and permit clients to acquire and market shares on supply exchanges. Committing in ETFs gives liquidity and simplicity of exchanging reviewed to physical possession.

Putting in in gold exploration stocks is however one more technique to profit coming from adjustments in the current gold cost. As the price of gold surge, exploration business often tend to see an increase in profits, leading to prospective increases for their investors.

It's worth keeping in mind that committing in any type of property brings risks, featuring puttin...

-

33:59

33:59

TudorDixon

16 hours agoA Story of Sacrifice and Service with Joe Kent | The Tudor Dixon Podcast

28.6K4 -

27:22

27:22

The Nima Yamini Show

8 hours agoAlpha Nima Crushes Nick Fuentes & Business Tips with Dylan

25.5K18 -

1:19:23

1:19:23

Mally_Mouse

7 hours agoLet's Hang - Cosplay Stream!!

43K2 -

1:05:06

1:05:06

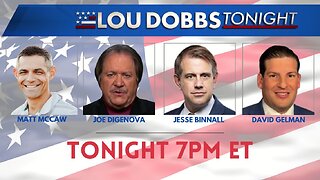

Lou Dobbs

14 hours agoLou Dobbs Tonight 5-31-2024

58.1K35 -

1:42:57

1:42:57

The Quartering

14 hours agoDonald Trump Conviction BACKFIRES, Massive Funds Raised, Democrats Swap Parties & More

94.3K94 -

26:11

26:11

Stephen Gardner

12 hours ago🔴HUGE TRUMP WIN! Biden, Hillary, Obama ALL IN BIG TROUBLE NOW!!

89.5K380 -

9:42

9:42

Breaking Points

1 day agoTERRIFIED Biden Moves DNC Online

75.1K75 -

1:09:34

1:09:34

Edge of Wonder

12 hours agoGravity Isn’t Real? Fact Checking Terrence Howard

48.8K14 -

1:37:04

1:37:04

2 MIKES LIVE

14 hours ago2 Mikes Live #73 Open Mike Friday 5-31-24

39.8K6 -

1:45:34

1:45:34

Total Horse Channel

1 day ago2024 Buckeye Reining Series | Friday Night | 7:30 pm EST

27.5K