Some Known Factual Statements About "Retirement Savings and Taxes: How to Optimize Returns and...

https://rebrand.ly/Goldco5

Sign up Now

Some Known Factual Statements About "Retirement Savings and Taxes: How to Optimize Returns and Minimize Liabilities" , retirement savings investment plan

Goldco assists clients safeguard their retirement financial savings by surrendering their existing IRA, 401(k), 403(b) or other competent retirement account to a Gold IRA. ... To learn how safe haven rare-earth elements can aid you build as well as secure your wide range, and also even protect your retirement call today retirement savings investment plan.

Goldco is just one of the premier Precious Metals IRA firms in the United States. Safeguard your wealth and also source of income with physical precious metals like gold ...retirement savings investment plan.

Branching out Your Investments: Safeguarding and Growing Your Retirement Savings

Considering for retired life is a crucial step to ensure financial security during the course of your gold years. One of the key components of retirement strategy is committing your savings wisely to safeguard and develop your funds. While there are various investment options offered, diversity plays a substantial duty in minimizing danger and making the most of returns. In this post, we will certainly check out the value of branching out your investments and how it may aid guard and grow your retired life savings.

What is Variation?

Variation recommends to dispersing your assets all over different possession classes, industries, fields, or geographical locations. The target is to generate a well balanced collection that lessens the impact of any kind of single assets performing inadequately on the total functionality of your collection.

Why Expand?

Variation is crucial because it aids take care of threat efficiently. By committing in a variety of properties, you reduce exposure to any sort of one financial investment's possible negative aspect. If one asset lesson executes inadequately, other financial investments within your portfolio might harmonize out those losses or also generate positive yields.

Additionally, diversification makes it possible for you to take advantage of prospective development chances across various industries and regions. Different possessions carry out properly at different times as a result of to market cycles or financial ailments. By diversifying, you improve the chance of recording beneficial yields coming from various financial investments.

Securing Your Retirement Savings

One of the main objectives when conserving for retirement is protecting capital while generating adequate revenue to maintain yourself throughout your non-working years. Transforming can assist protect your retirement savings by minimizing vulnerability to market dryness.

For example, if a significant portion of your cost savings is invested exclusively in sells and there's a abrupt decline in the stock market, you could experience substantial reductions that might take years to bounce back from. Nevertheless, by expanding in to other resource training class such as connections or real real estate assets relies on (REITs), you can easily possibly made up for those reductions along with stable profit streams or even funds recognition.

Furthermore, diversity helps protect versus sector-specific dangers. If you invest greatly in a particular field, such as technology, and that sector experiences a slump, your whole collection can go through. However, through spreading your financial investments throughout different industries like healthcare, individual goods, or power, you can easily reduce the influence of any sort of solitary field's unsatisfactory functionality.

Expanding Your Retirement Savings

While guarding your retired life financial savings is critical, it is just as essential to grow your investments to maintain rate along with inflation and satisfy your financial targets. Diversity may play a considerable job in accomplishing this purpose.

Various resource courses possess various danger and come back profile pages. Through branching out all over asset lessons such as sells, connections, true estate, and items like gold or oil, you can easily possibly gain greater yields while taking care of risk properly. This is because when one resource course underperforms in the course of a certain duration, another asset class may be experiencing beneficial growth.

Additionally, variation gives exposure to various topographical locations. Putting...

-

1:36:46

1:36:46

Roseanne Barr

8 hours agoFor Love of Country with Tulsi Gabbard | The Roseanne Barr Podcast #50

77.3K122 -

33:59

33:59

TudorDixon

15 hours agoA Story of Sacrifice and Service with Joe Kent | The Tudor Dixon Podcast

25.7K4 -

27:22

27:22

The Nima Yamini Show

7 hours agoAlpha Nima Crushes Nick Fuentes & Business Tips with Dylan

21.4K15 -

1:19:23

1:19:23

Mally_Mouse

7 hours agoLet's Hang - Cosplay Stream!!

38.4K2 -

1:05:06

1:05:06

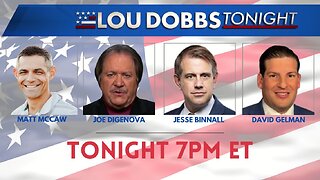

Lou Dobbs

13 hours agoLou Dobbs Tonight 5-31-2024

53.1K33 -

1:42:57

1:42:57

The Quartering

13 hours agoDonald Trump Conviction BACKFIRES, Massive Funds Raised, Democrats Swap Parties & More

88.8K94 -

26:11

26:11

Stephen Gardner

11 hours ago🔴HUGE TRUMP WIN! Biden, Hillary, Obama ALL IN BIG TROUBLE NOW!!

85.9K376 -

9:42

9:42

Breaking Points

1 day agoTERRIFIED Biden Moves DNC Online

72.9K67 -

1:09:34

1:09:34

Edge of Wonder

11 hours agoGravity Isn’t Real? Fact Checking Terrence Howard

47.2K14 -

1:37:04

1:37:04

2 MIKES LIVE

13 hours ago2 Mikes Live #73 Open Mike Friday 5-31-24

39.8K6